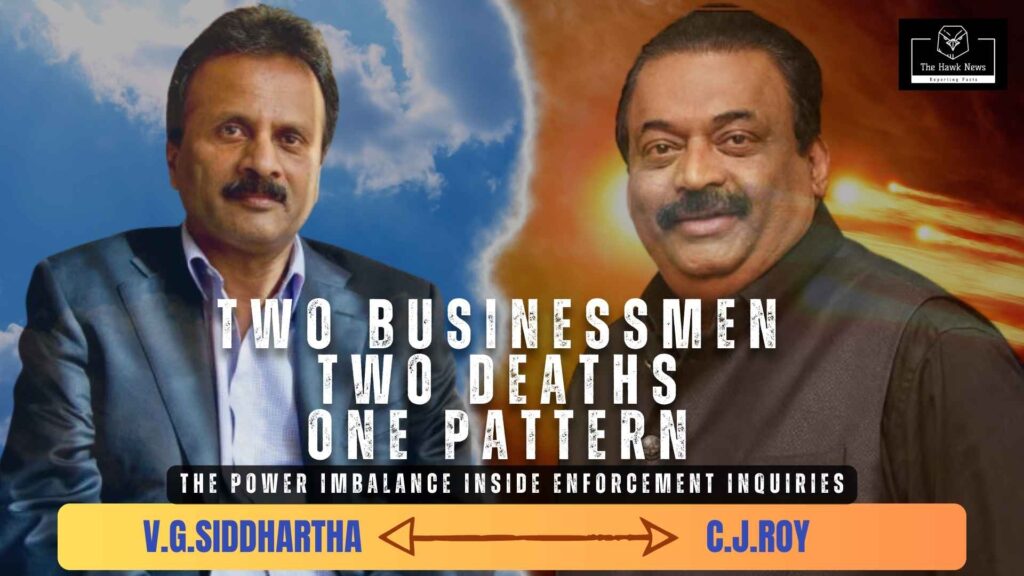

The deaths of CJ Roy, chairman of the Confident Group, and V G Siddhartha, founder of Cafe Coffee Day, occurred nearly seven years apart and in entirely different business sectors. Yet both cases unfolded against a strikingly similar backdrop: sustained financial stress combined with intense scrutiny from the Income Tax Department.

These were not isolated personal tragedies. They were deaths that happened during active regulatory pressure. When such outcomes repeat across time and industries, the issue moves beyond individual circumstance and into the realm of institutional conduct.

India cannot afford to ignore that pattern.

Experienced Entrepreneurs Who Understood Regulation

CJ Roy and V G Siddhartha were not inexperienced businessmen suddenly overwhelmed by official attention.

Roy had spent decades building real estate operations across Karnataka, Kerala, and overseas markets. His group employed hundreds and regularly dealt with lenders, auditors, and statutory authorities. He had navigated regulatory environments long before the Income Tax inquiry that preceded his death.

Siddhartha built Cafe Coffee Day into one of India’s most recognisable consumer brands. He expanded internationally, managed private equity partnerships, and operated within complex corporate and funding structures. He had engaged with banks and regulators throughout his career.

Both men were accustomed to scrutiny. Their deaths cannot be reduced to shock from first-time enforcement action. They reflect prolonged pressure applied to individuals already carrying significant financial and reputational burdens.

Income Tax Scrutiny as a Shared Context

In Siddhartha’s case, a letter attributed to him surfaced after his death, stating that he was under unbearable pressure from lenders and alleged harassment by tax officials. While the Income Tax Department disputed wrongdoing and questioned parts of that narrative, the public impact was immediate and lasting. For the first time at a national scale, a major entrepreneur had explicitly linked his psychological collapse to regulatory pressure.

Subsequent investigations revealed that Siddhartha’s business was already in deep financial distress, marked by heavy borrowing, inter-company fund movements, and mounting obligations to investors. Regulatory scrutiny entered at a moment when his corporate structure was fragile.

CJ Roy’s death followed a similarly troubling sequence. He died inside his Bengaluru office while Income Tax officials were conducting searches and questioning him. Reports indicate that the inquiry had continued over several days. No suicide note has been publicly disclosed, but the timing alone raises serious concerns.

In both cases, the businessmen were under active Income Tax scrutiny when their lives ended. That shared context demands careful examination.

The Power Imbalance Inside Enforcement Inquiries

Officially, an Income Tax inquiry is a technical process involving documentation, clarification, and verification. In practice, it is a deeply unequal encounter.

Officials control the pace, duration, and direction of questioning. The individual under inquiry faces uncertainty over business continuity, reputation, and potential legal consequences. There is rarely an independent observer present. Interrogations are not routinely recorded. The psychological environment remains undocumented.

CJ Roy was questioned inside his own workplace, reportedly in the presence of employees. Siddhartha faced repeated regulatory engagement while simultaneously dealing with severe financial stress.

These settings are inherently destabilising. Legal scholars and behavioural analysts have long noted that prolonged questioning, especially when combined with public exposure and economic pressure, can significantly impair judgment and emotional resilience. Yet India has no uniform protocol governing interrogation length, mental health safeguards, or transparent documentation of enforcement conduct.

Public Exposure and the Collapse of Professional Standing

Enforcement actions are rarely discreet.

Raids become visible. Employees witness questioning. Documents are seized publicly. News travels quickly through offices, markets, and media.

For a business owner, this is not merely administrative inconvenience. It is reputational collapse unfolding in real time.

Authority built over decades can evaporate within hours. If Roy was questioned aggressively in front of his staff, the psychological damage would have extended far beyond legal discomfort. It would have struck directly at his credibility as a leader.

Siddhartha experienced a comparable erosion of confidence, intensified by investor pressure and media scrutiny. In both cases, regulatory action intersected with public visibility, creating a powerful spiral of stress that compounded existing vulnerabilities.

Financial Fragility Meets Institutional Force

Siddhartha’s death was preceded by a severe liquidity crisis. Investigations later pointed to extensive borrowing, complex fund transfers between group entities, and pressure from private equity partners seeking buybacks. His financial position was already precarious.

Regulatory scrutiny arrived during this fragile phase.

The combination proved catastrophic.

CJ Roy’s complete financial exposure has not yet been mapped publicly to the same extent, but early reporting suggests he too was under strain when sustained questioning began.

Corporate analysts have repeatedly warned that enforcement agencies must exercise heightened care when promoters are already financially vulnerable. Pressure applied at such moments can push individuals beyond recovery. India’s enforcement framework, however, offers little institutional sensitivity to this reality.

Entrepreneurs Treated as Presumed Offenders

Both cases expose a deeper structural problem.

India’s enforcement culture often approaches entrepreneurs primarily as suspects rather than stakeholders in economic growth. Business owners generate employment, pay taxes, and sustain local economies. That does not place them above the law, but it does require dignity, proportionality, and restraint in investigative processes.

Instead, allegations frequently surface before trials. Reputations suffer long before courts intervene. The inquiry itself becomes a form of punishment.

CJ Roy and V G Siddhartha were caught inside this system. Their deaths reveal the human cost of enforcement without safeguards.

A Repeating Institutional Response

The aftermath of such tragedies follows a familiar pattern.

Public shock is followed by official denials. Investigations are announced. Statements promise reform. Then attention fades.

After Siddhartha’s death in 2019, there was widespread debate about regulatory overreach. Yet no meaningful structural changes followed. There was no mandatory recording of interrogations, no independent civilian oversight of tax enforcement, and no national protocol governing humane inquiry practices.

Following CJ Roy’s death, authorities have announced a Special Investigation Team. That step is necessary. But unless the investigation examines not only the final act but also the conduct leading up to it, the outcome will be symbolic rather than transformative.

Accountability Rarely Moves Upward

True accountability requires examining process, not just outcome.

How long was questioning conducted each day?

What language was used?

Were adequate breaks provided?

Was legal counsel continuously available?

Was psychological pressure considered?

These are not minor procedural details. They are central to determining whether enforcement crossed ethical boundaries.

In Siddhartha’s case, no enforcement officer faced visible consequences. That absence of accountability established a precedent. Power exercised without consequence tends to repeat itself.

The Democratic Cost of Fear-Based Compliance

A democracy is not measured by the number of raids it conducts. It is measured by how power behaves when citizens are most vulnerable.

If businessmen comply because they are afraid rather than because they trust the legal system, democratic legitimacy erodes quietly. If bureaucrats function as investigator, judge, and enforcer, the role of courts diminishes.

CJ Roy and V G Siddhartha died within this imbalance. Their deaths reflect institutional excess, not individual weakness.

A Pattern India Can No Longer Ignore

Though separated by years and industries, both cases reveal the same troubling convergence: financial vulnerability combined with aggressive regulatory pressure, public exposure, and the absence of humane enforcement safeguards.

This is not coincidence. It is a pattern.

And patterns demand reform.

Until interrogation protocols are codified, until enforcement officers are accountable for psychological harm, and until inquiries are conducted with transparency and restraint, similar tragedies will continue.

A Reckoning That Cannot Be Postponed

If inquiry exists to gather evidence, it must not leave bodies behind. If law exists to protect citizens, citizens must not fear it.

CJ Roy and V G Siddhartha did not die in isolation. They died within a system that too often confuses authority with righteousness.

India owes them more than condolences.

It owes them structural change.

Because somewhere today, another businessman is sitting inside an inquiry room. And the system has yet to demonstrate that it knows how to stop.