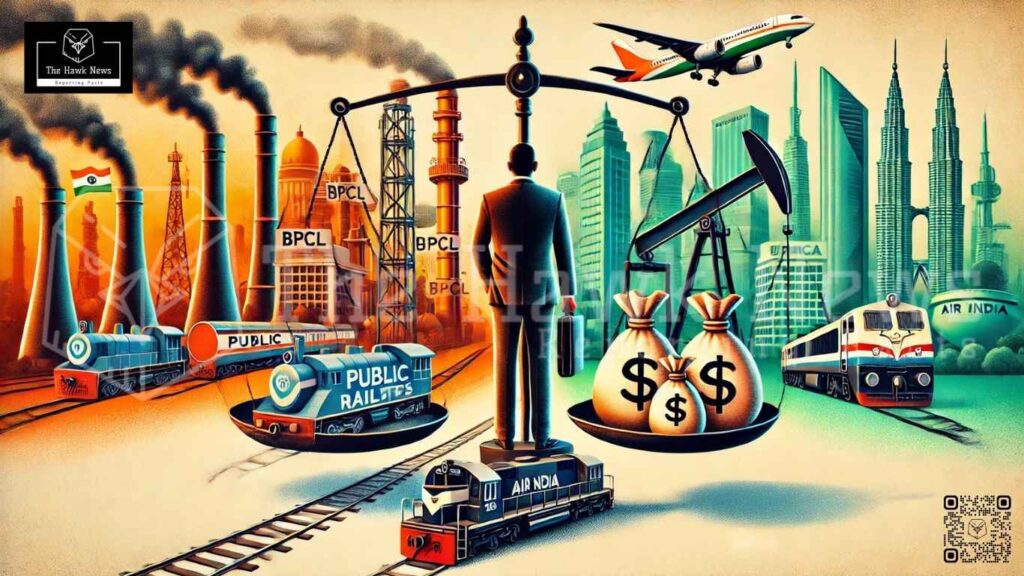

Is the Central Government of India Acting as an Agent for Private Entities in Selling National Assets?

The question of whether the Central Government of India is functioning as an agent for private entities to sell national assets warrants a serious discussion. The assets in question were created using taxpayer money, collected from millions of hardworking citizens over decades. Critics argue that the government’s aggressive disinvestment and privatization drive disproportionately benefits private players, sidelining the collective ownership of the public.

Historical Context: Building National Assets

India’s tryst with nation-building began after independence in 1947. With a mixed economy model, the government focused on creating public sector enterprises (PSEs) to drive industrialization, employment, and economic growth. These enterprises, funded largely by taxpayers’ money, were intended to serve the nation’s broader interests.

For instance, in the 1950s and 1960s, the government established iconic entities like Indian Railways, State Bank of India (SBI), Steel Authority of India Limited (SAIL), and Oil and Natural Gas Corporation (ONGC). These institutions not only became the backbone of India’s economy but also played a crucial role in ensuring equitable access to resources and services.

Shift in Economic Policy

The 1991 liberalization marked a pivotal shift in India’s economic strategy. Faced with a balance of payments crisis, the government opened up several sectors to private players. While this move ushered in much-needed economic growth, it also initiated the era of privatization and disinvestment.

In recent years, this policy has been aggressively pursued under the banner of “Aatmanirbhar Bharat” (self-reliant India). However, critics argue that rather than empowering citizens, this drive is leading to the privatization of strategic and profitable public assets.

Disinvestment: A Cause for Concern?

The government’s disinvestment strategy has included outright sales and long-term leasing of major public assets. Several cases have raised concerns about transparency, fairness, and the long-term implications of such decisions.

- Air India: Founded in 1932 by J.R.D. Tata and later nationalized in 1953, Air India became a symbol of India’s post-independence aspirations. After years of financial strain, it was sold back to the Tata Group in 2021 for ₹18,000 crore. While some hailed this as a necessary move, others questioned why a once-profitable airline was allowed to sink into debt and how its sale price was determined.

- BPCL (Bharat Petroleum Corporation Limited): A Navratna company and one of India’s most profitable PSEs, BPCL has been on the government’s privatization radar. Despite its critical role in energy security, it is being prepared for sale to private players, raising alarms about strategic control over a key sector.

- Ports and Airports: The Adani Group has emerged as a significant beneficiary of the government’s asset monetization drive. Between 2019 and 2021, the group gained control of six airports, including those in Ahmedabad, Mangaluru, and Lucknow, under a public-private partnership (PPP) model. Similarly, major ports like the Krishnapatnam and Dighi ports have also been handed over to private entities.

- LIC (Life Insurance Corporation of India): LIC, a cornerstone of India’s financial system and a trusted brand among millions, was partially privatized through an Initial Public Offering (IPO) in 2022. Critics argue that selling shares in such a profitable and socially impactful institution undermines its public-oriented mission.

- Railways Privatization: The government has also opened up several aspects of Indian Railways, including freight corridors and passenger trains, to private players. This move has been criticized for prioritizing profits over affordable services for the common man.

Taxpayers’ Money and Public Ownership

Public sector enterprises were funded through taxes collected from ordinary citizens. These taxes represent the sacrifices of countless Indians who contributed to nation-building with the expectation that these assets would serve public interests. The ongoing privatization drive has led many to believe that their contributions are being undervalued or misused.

For instance, the privatization of profitable entities like BPCL or the partial sale of LIC raises questions about the need for such measures. If these entities are already generating revenue, why sell them? Critics argue that the focus should be on improving efficiency and governance, not handing over control to private monopolies.

Implications of Privatization

The sale of public assets to private entities can have far-reaching consequences:

- Loss of Strategic Control: Sectors like energy, transport, and finance are critical to national security and economic stability. Selling them to private players, especially foreign entities, could compromise India’s strategic interests.

- Increased Inequality: Privatization often leads to higher costs for consumers, as private companies prioritize profits. Essential services like transportation, healthcare, and energy may become unaffordable for the common man.

- Job Losses: Public sector enterprises have historically provided stable employment. Privatization, however, often leads to job cuts and reduced benefits.

- Short-Term Gains vs. Long-Term Stability: While disinvestment might help the government meet fiscal targets in the short term, it sacrifices long-term revenue streams.

Conclusion

The aggressive privatization of India’s public assets raises significant concerns about accountability, equity, and national interest. Public assets are not just economic resources; they represent decades of effort and sacrifice by millions of Indians. Selling them off without adequate safeguards risks alienating the very citizens who funded their creation.

Rather than acting as an agent for private entities, the government must prioritize transparency, public consultation, and equitable development. The question remains: Are we building a nation for the people, or a market for the privileged few?